1.9 Trillion Dollars

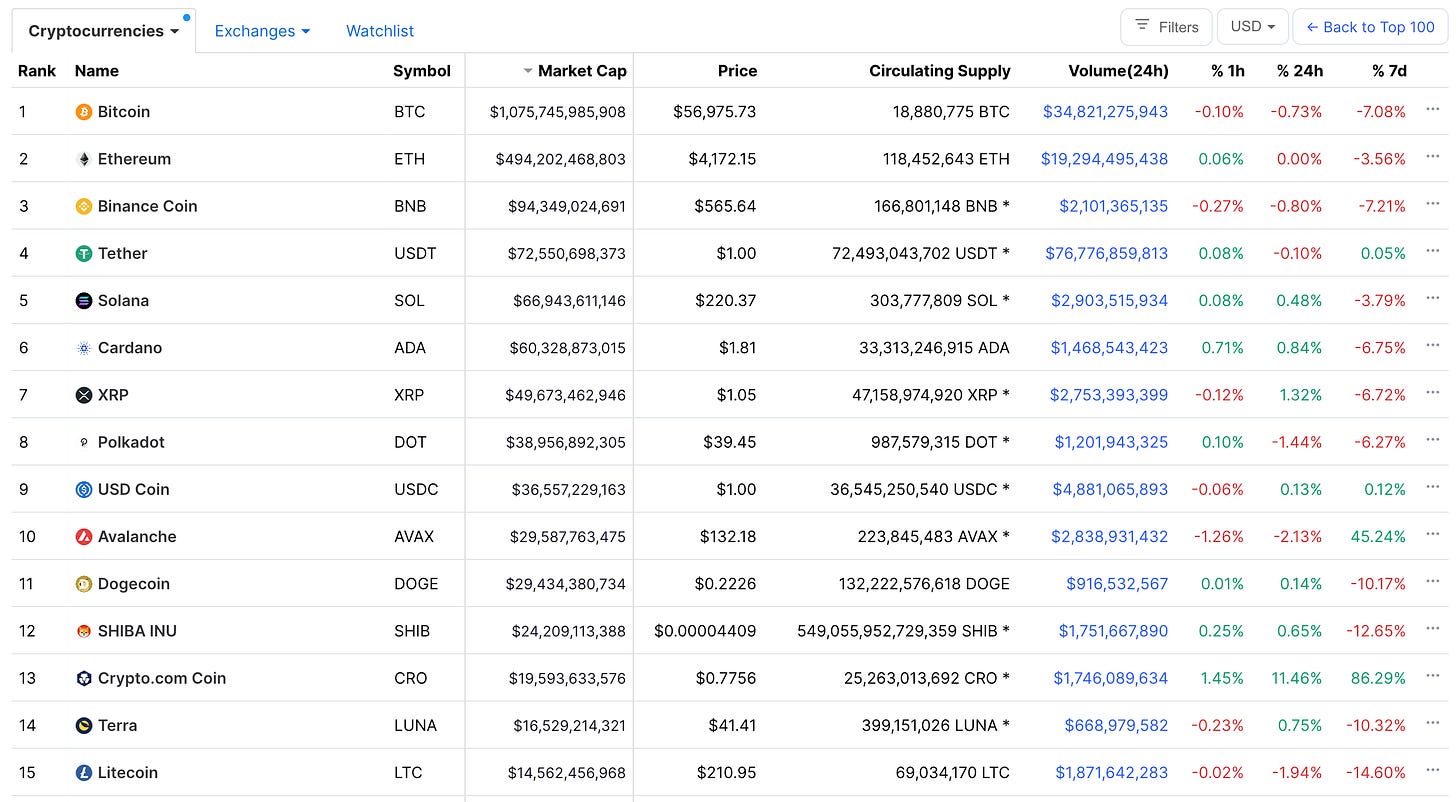

After doing research for last week's letter on Decentralized Finance (DeFi), I was left wondering what different cryptocurrencies actually do. And why on earth are they worth so much? This week, I take a look at the most popular cryptocurrencies by market capitalization and try to find thematic trends. First, here's a list of the top cryptocurrencies. The market capitalization of all the cryptocurrencies combined has grown over 600% from $397 billion in November 3, 2020 to $1.9 trillion US dollars as of September 26, 2021. For reference, the entire company of Google is worth the same amount. The entire company of Google... From the chart below, it appears that the lion share of market capitalization is tied to Bitcoin and Ethereum (~1.5 trillion US dollars).

Perhaps due to the recent hype, many retail and institutional investors around the world might just be temporarily parking their money into these two cryptocurrencies for a host of reasons: alternative investment strategies, fear of missing out, inflationary hedges against fiat currencies, just for "shits", I'm not exactly sure why. What is interesting though is that with all this money circulating around the cryptocurrency ecosystem, a lot of innovators are building interesting use cases for the technology. I took a look at the top 50 cryptocurrencies to see what they do. Here's what I found.

The Triple Meaning of Blockchains

A lot of the top cryptocurrencies are both coins AND their own unique blockchains.

Ethereum is a blockchain. It is also the name of the non-profit organization that created the Ethereum Blockchain. It is ALSO the name of the cryptocurrency that can be mined from the Ethereum Blockchain. Unfortunately, this can be confusing, but knowing the distinction elucidates a few major trends in the top 50 cryptocurrencies...

Trend 1 - Novel Blockchains

Near, Polkadot, and Solana are just 3 of many other blockchains that exist in the top 50 cryptocurrencies list. Anyone can "mine" cryptocurrency from these blockchains and trade the mined currency in an open market. The "Circulating Supply" and "Volume 24h" columns in the figure above give a sense that these currencies are fairly liquid. Different blockchains can have different “mining” rules that establishes the value of their cryptocurrencies in different ways.

Trend 2 - Forks

Any company or group of engineers can "build" a blockchain by simply writing software. The group can then launch a blockchain to the world so that anyone can interact with it (i.e. mine for its cryptocurrency). Some groups, like Ethereum, make the code for their blockchains publicly viewable or open-source. Some groups keep their code private and even patent their code (Hedera). Ethereum and Bitcoin have publicly available code. As a result, some groups of people actually downloaded a snapshot of their codebase in time and made modifications/improvements, and then released new blockchains. The 6 cryptocurrencies below are ALL in the top 50 cryptocurrencies and are “forks” of Ethereum and Bitcoins’ codebases.

Forks of Ethereum

EOS

Ethereum Classic

Wrapped Bitcoin

Forks of Bitcoin

eCash

Litecoin

Bitcoin Cash

Trend 3 - Stable coins

Stable coins are a class of cryptocurrencies that are pegged 1:1 with a traditional fiat currency. They ultimately serve to provide interoperability between fiat and crypto. USDC is a cryptocurrency actually started by Coinbase to provide liquidity for its retail investors. Dai, Terra and Binance USD all do a similar thing. All 4 are in the Top 50.

Trend 4 - Meme coins

These are coins that have seen lots of volatility mainly because they've been getting media attention. Dogecoin, Shiba Inu are two cryptocurrencies in the Top 50 that fall into this category. They are not "technology-first" per se.

Trend 5 - Tokens inside the Ethereum Network

Many of the top 50 cryptocurrencies are actually “tokens” on Ethereum's blockchain. These cryptocurrencies are called tokens and differ from coins. The word coin is typically reserved for the cryptocurrency mined explicitly from a blockchain. Ethereum (the organization) built a feature on its blockchain that allows 3rd-Party Developer teams to "mint new tokens". These are tokens that are usually tied 1:X (some fixed ratio) in supply to Ethereum coins. This fixed ratio allows the circulating supply of these coins to remain stable without having to reinvent an entirely new blockchain.

Trend 6 - Purpose-Built Coins/Tokens

Many cryptocurrencies are coins or tokens that are purpose-built and tied to real physical or digital assets.

XRP: Designed to have low fees when making cross-border payments

THETA: Coins are tied to real videos (digital assets) that can be traded

Filecoin: Coins are tied to real files (digital assets) that can be traded

Chainlink: Coins are tied to public data streams (digital assets) that can be traded

Thanks for reading! Let me know what you think about these trends, and where this is all going.

Best,

Vihar Desu

I’m investing in some of these today. I like number 6 a lot